Forex trading is a fascinating and exciting way to make money. It is a massive market that sees over $6 trillion in transactions per day. However, it is not as easy as it seems. To be successful in the forex market, one needs to know how to analyze the market correctly. There are two types of analysis: fundamental and technical analysis. Fundamental analysis examines factors like economic news, political events, and global market trends. Technical analysis, on the other hand, is the study of charts and market patterns. In this blog, we will delve deeper into technical analysis, how it works, and why it is a vital tool for forex traders.

1. Understanding Technical Analysis

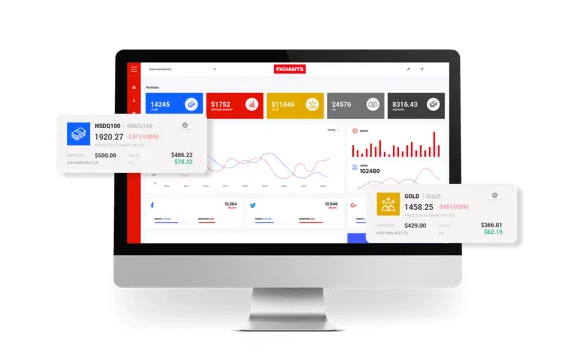

Technical analysis is the study of charts and price patterns. It helps traders identify trading opportunities and make informed decisions. It is based on the principle that market prices move in trends and that history tends to repeat itself. Technical analysts use charts and technical indicators to study market trends and predict future price movements. The most common technical indicators include moving averages, oscillators, and support and resistance levels.

2. Using Technical Analysis Effectively

To use technical analysis effectively, traders must learn how to read various chart patterns and understand technical indicators. For example, if you want to trade the EUR/USD pair, you need to understand its price patterns, support and resistance levels, and how different economic news might affect its price. Technical analysis can help you identify trends and patterns that are not visible through fundamental analysis. It can also help you predict where prices might move next.

3. The Advantages of Technical Analysis

There are several benefits of technical analysis. First, it is easy to learn and use. Unlike fundamental analysis, which requires in-depth knowledge of the market, technical analysis can be used by anyone. Second, it is efficient. With the help of software tools and indicators, traders can analyze charts and identify trends quickly. Third, it can be used in any market. Whether you trade stocks, forex, or commodities, technical analysis works in all markets. Lastly, it helps traders make informed decisions. By studying charts and patterns, traders can make informed decisions based on facts rather than emotions.

4. Combining Technical Analysis with Other Types of Analysis

While technical analysis is essential for forex trading, it is not the only tool you need to be successful. Many traders combine technical analysis with other types of analysis, such as fundamental analysis, to get a full understanding of the market. Combining different types of analysis can help you get a more accurate picture of the market, which can lead to better trading decisions.

5. Conclusion

In conclusion, technical analysis is an essential tool for forex traders. It helps traders identify trading opportunities, predict price movements, and make informed decisions. However, it is not a magic potion that guarantees success. To be successful in the forex market, traders must combine it with other types of analysis, stay updated with market news and trends, and develop their trading skills over time. By doing so, they can improve their chances of success and make the most out of this exciting and lucrative market.